KUALA LUMPUR: Bursa Malaysia ended higher across the board today, with the benchmark FTSE Bursa Malaysia KLCI (FBM KLCI) ending at a 20-month high, the highest level since June 2022, supported by steady buying from foreign investors.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said foreign buyers were seen actively participating in today’s trading and buying blue chips.

“It looks like the funds are flowing back to the region,” he told Bernama, adding that the Hong Kong and China markets are still closed due to the Chinese New Year celebration.

He noted that the FBM KLCI had breached the 1,527-resistance level, supported by strong buying from foreign funds.

“We maintain our cautiously optimistic view on the local stock market, fuelled by its enticing valuations and continuous support from foreign inflows, although we do not discount the possibility of profit-taking activities.

“Should the FBM KLCI manage to maintain its position above the 1,527 level over an extended period, there is potential for the index to make additional advancements.”

Therefore, he said Rakuten anticipates the benchmark index to trend within the 1,520-1,540 range for the week.

Meanwhile, MIDF Research reported that foreign investors maintained their net buying streak on Bursa Malaysia, with an inflow of RM400.7 million, marking the third consecutive week of net purchases.

In its Fund Flow Report for the week ended Feb 9, 2024, the research house said foreigners recorded net buying every day, with Tuesday witnessing the highest inflow of RM188.9 million.

In addition, Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said today’s surge was primarily driven by robust performance in the banking, energy, and plantation sectors.

“Additionally, the bullish momentum on Wall Street may have played a role in propelling the benchmark index upwards, with the S&P 500 hitting record highs and surpassing 5,000 points, as investors await the release of the US Consumer Price Index data later this evening,” he added.

At the same time, Redtone Digital was in the limelight after it secured a 60-month MyGovUC 3.0 contract from the Malaysian Administrative Modernisation and Management Planning Unit worth about RM398.1 million.

The counter closed at RM1.04 today, a fresh high since 2005, with 11.7 million shares traded.

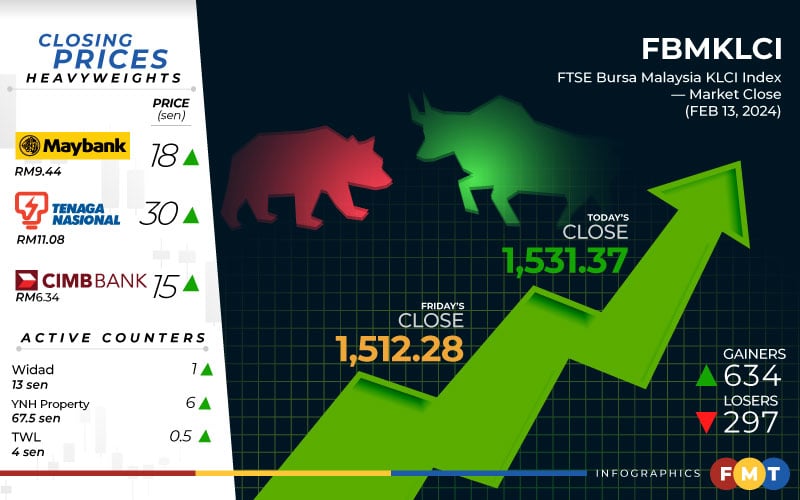

At 5pm, the market bellwether jumped 19.09 points to 1,531.37 from Friday’s close of 1,512.28.

The market was closed yesterday (Feb 12) for the Chinese New Year replacement holiday.

The FBM KLCI opened 0.35 of-a-point higher at 1,512.63 and moved between 1,512.63 and 1,533.16 throughout the day.

Gainers trounced losers 634 to 297 on the broader market, while 425 counters were unchanged, 927 untraded and 11 others suspended.

Among the heavyweights, Maybank added 18 sen to RM9.44, TNB surged 30 sen to RM11.08, CIMB climbed 15 sen at RM6.34, Petronas Chemicals improved 13 sen to RM6.84, while Public Bank added five sen at RM4.40.

As for the actives, Widad rose one sen to 13 sen, YNH Property was six sen better at 67.5 sen, TWL advanced 0.5 sen to four sen, MYEG improved 1.5 sen at 81 sen, and Reneuco was unchanged at 5.5 sen.

On the index board, the FBM Emas Index was 128.99 points higher at 11,374.01, the FBMT 100 Index advanced 125.28 points to 11,029.79, the FBM 70 Index put on 123.98 points to 15,334.31, the FBM Emas Shariah Index increased 126.46 points to 11,412.64, and the FBM ACE Index expanded 11.31 points to 4,833.52.

Sector-wise, the property index went up 15.21 points to 927.56, the plantation index rose 84.47 points to 7,276.63, and the energy index improved 3.44 points to 891.40.

The financial services index soared 267.29 points to 17,148.26 while the industrial products and services index added 2.07 points to 174.46.

The Main Market volume expanded to 1.57 billion units worth RM1.93 billion from last Friday’s 1.08 billion units worth RM933.56 million.

Warrants turnover dwindled to 205.28 million units worth RM27.91 million from 448.53 million units worth RM71.83 million last Friday.

The ACE Market volume improved to 332.83 million shares valued at RM85.91 million from 325.18 million shares worth RM88.91 million previously.

Consumer products and services counters accounted for 231.98 million shares traded on the Main Market, industrial products and services (372.47 million); construction (144.36 million); technology (143.75 million); SPAC (nil); financial services (69.2 million); property (277.6 million); plantation (17.36 million); REITs (20.6 million), closed/fund (16,100); energy (98.54 million); healthcare (50.49 million); telecommunications and media (37 million); transportation and logistics (27.6 million); and utilities (78.21 million).

Desain Rumah Kabin

Rumah Kabin Kontena

Harga Rumah Kabin

Kos Rumah Kontena

Rumah Kabin 2 Tingkat

Rumah Kabin Panas

Rumah Kabin Murah

Sewa Rumah Kabin

Heavy Duty Cabin

Light Duty Cabin

Source