Bursa ends lower as profit-taking continues

KUALA LUMPUR: Bursa Malaysia struggled to make significant progress above the 1,550 level and ended lower today due to profit taking activities following recent gains.

SPI Asset Management managing partner Stephen Innes said in the current market landscape, there’s a noticeable disparity among different markets.

“While major US indices, particularly those dominated by mega tech companies in the artificial intelligence sector, continue to hit record highs despite concerns over rising US inflation and robust personal income growth, local stocks are grappling with challenges such as higher US yields and weaker manufacturing purchasing managers’ index (PMI) data from China.

“The latter indicates ongoing contraction in the manufacturing sector, which is weighing on investor sentiment,” he told Bernama.

Meanwhile, Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng said Bursa trended lower as profit taking continued following the recent rally.

Meanwhile, key regional indices trended higher following positive economic data from China.

“Official data revealed that China’s manufacturing PMI for February matched the Reuters poll forecast at 49.1, while the private Caixin manufacturing final PMI recorded a slightly higher figure of 50.9, up from the previous month’s 50.8.

“At the same time, the US January personal consumption expenditures price index came in within estimates, fuelling expectations that the Federal Reserve will implement interest rate cuts by June,” he said.

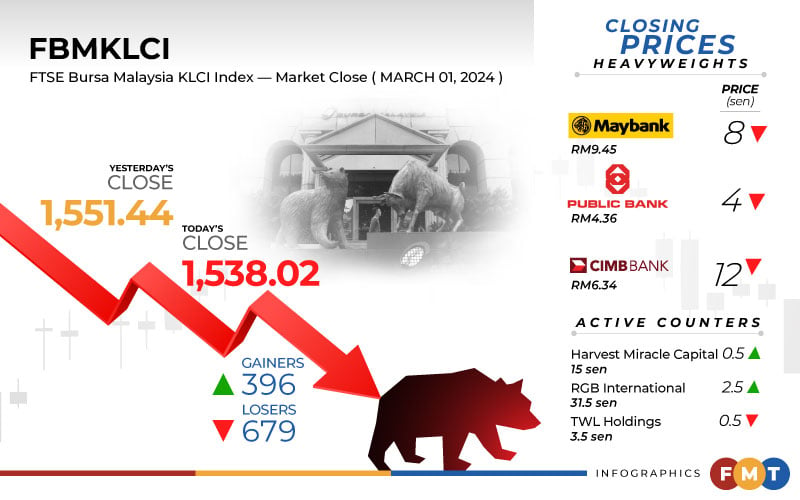

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) eased 13.42 points to close at 1,538.02 from yesterday’s close of 1,551.44.

The benchmark index, which opened 1.72 points firmer at 1,553.16, moved between 1,537.11 and 1,556.22 throughout the day.

On the broader market, losers outpaced gainers 679 to 396, while 448 counters were unchanged, 737 untraded, and 23 others suspended.

Turnover narrowed to 4.82 billion units worth RM3.09 billion versus yesterday’s 5.34 billion units worth RM7.01 billion.

Among the Bursa heavyweights, Maybank lost 8 sen to RM9.45, Public Bank slid 4 sen to RM4.36, CIMB trimmed 12 sen to RM6.34, and Petronas Chemicals edged down 7 sen to RM6.93. However, Tenaga Nasional rose 4 sen to RM11.30.

As for the actives, Harvest Miracle Capital inched up 0.5 sen to 15 sen, RGB International gained 2.5 sen to 31.5 sen, and TWL Holdings shed 0.5 sen to 3.5 sen, while Borneo Oil and Velesto Energy were flat at 1 sen and 28.5 sen, respectively.

On the index board, the FBM Emas Index declined 81.51 points to 11,410.31, the FBMT 100 Index went down 83.43 points to 11,074.77, the FBM Emas Shariah Index decreased 56.44 points to 11,471.55, the FBM 70 Index fell 61.43 points to 15,384.72, and the FBM ACE Index edged down 7.77 points to 4,760.36.

Sector-wise, the financial services index dropped 141.28 points to 17,175.22, the utilities index slipped 14.36 points to 1,524.64, the industrial products and services index eased by 0.5 of-a-point to 175.78, and the energy index reduced by 15.05 points to 909.65, but the plantation index was 29.19 points higher at 7,223.86.

The Main Market volume narrowed to 3.29 billion units valued at RM2.83 billion from 3.69 billion units valued at RM6.74 billion yesterday.

Warrants turnover fell to 931.75 million units worth RM125 million from 1.11 billion units worth RM145.8 million yesterday.

The ACE Market volume grew to 579.47 million shares worth RM131.61 million from 546.8 million shares worth RM127.64 million previously.

Consumer products and services counters accounted for 411.86 million shares traded on the Main Market, industrial products and services (1.31 billion); construction (152.78 million); technology (263.16 million); SPAC (nil); financial services (148.72 million); property (325.54 million); plantation (97.16 million); REITs (35.47 million), closed/fund (54,200); energy (313.38 million); healthcare (54.11 million); telecommunications and media (25.69 million); transportation and logistics (39.75 million); and utilities (111.54 million).

Desain Rumah Kabin

Rumah Kabin Kontena

Harga Rumah Kabin

Kos Rumah Kontena

Rumah Kabin 2 Tingkat

Rumah Kabin Panas

Rumah Kabin Murah

Sewa Rumah Kabin

Heavy Duty Cabin

Light Duty Cabin

Source